Setting 1 with connection with a cash register. Online cash desks and trading operations in 1C. How to work with a cash register at a manual point of sale

In 2017, new rules for trading using electronic checks are introduced. One of the mandatory requirements will be to connect to the fiscal data operator (OFD), which ensures the collection, storage and transmission of data from the cash register to the tax office.

To work with OFD, we chose ATOL 55F cashier, which meets the requirements of 54-FZ and is included in the register of cash registers.

How does OFD work?

After the buyer makes a purchase, the cash register creates a transaction and sends it to the fiscal accumulator.

The fiscal drive saves the receipt, signs it with a fiscal sign and sends the data to the FDO servers.

In turn, the OFD creates a reciprocal fiscal indicator, which it sends back to the cash register and transfers the data on the calculations to the tax office.

The entire chain of actions takes only a few seconds.

After that, the buyer receives a paper and electronic check (sent to e-mail or subscriber number). These checks contain a QR code and a link that the buyer can use to check the check with special services.

How to set up KKM ATOL 55F to work with 1C via RDP?

Installing KKM ATOL 55F on a local computer

First, you need to install the POS printer drivers on the computer to which the cash register will be connected. The driver can be downloaded from the official ATOL website or from [email protected].

After installing the driver, it will occupy 2 ports, in our case it is Com3 and Com4.

Why did the driver occupy 2 ports? It's that simple! One port will be used to exchange information with the cash register, the second port will be used to transfer data from the FDO.

We connect the KKM to the computer and proceed with the configuration.

Now we need to enter the "Driver Management" application. To do this, go to Start - All Programs - ATOL - Shop Equipment Drivers v. 8 - Driver management. In the window that opens, we need to activate the free version. Free version works with ATOL KKM, for other KKM Full version is required.

You can check the work of the cash register through the "POS printer driver" application. To do this, go to Start - All Programs - ATOL - Shop Equipment Drivers v. 8 - Tests - POS printer driver.

In the window that opens, we go to the "Setting properties ..." section and click "Search for equipment". Select the KKM model from the list, mark the required ports and all speeds of the COM ports. Click Search and wait until there are KKMs. After the cash register is found, you need to select our cash register and click "Create".

Now, if you check the box next to "Device is turned on", go to the "Setting properties ..." section and click "Check connection", then in the "Result" field we will get the name of our KKM, serial number and firmware version. This means that our cash desk is working.

The driver does not allow several programs to work through one COM port, so close the "POS printer driver" and continue with the configuration.

We return to "Driver Management" and go to the "FDSVC Service" tab. The service must be started if it is not running. This service will track our requests from 1C to port 6220. If the computer to which you are connecting via RDP is not in your local network, then you need to open port 6220 to connect via the Internet.

Configuring KKM ATOL 55F on a remote computer RDP

On local computer We have configured the KKM, now we need to make the cash register work with 1C on a remote desktop, to which we connect via the Internet. Administrator rights are required to install drivers on a remote server!

To do this, we do the same. Install the drivers, turn on the free mode.

Unzip the FR-ATOL_54FZ.zip file from the "C: \ Program Files (x86) \ ATOL \ Drivers8 \ 1Cv82" folder into bin folder platforms 1C. Now, just in case, you need to manually register FprnM1C82_54FZ.dll in system registry if this did not happen during the installation of the drivers. To do this, run Windows PowerShell as administrator and write the following command:

Regsvr32 "C: \ Program Files (x86) \ 1cv8 \ 8.3.9.2170 \ bin \ FprnM1C82_54FZ.dll"

Your path to FprnM1C82_54FZ.dll may be different! It all depends on what version of 1C you have and where it is installed.

Setting up KKM ATOL 55F in 1C Comprehensive automation

Now let's start configuring the KKM in 1C. In our case, we set up the KKM in 1C Integrated Automation 1.1. I think in other configurations the setting is not very different.

We run 1C as administrator (otherwise the drivers may not be loaded). We switch the interface to "Full". Go to "Service" - "Commercial equipment" - "Connecting and configuring commercial equipment".

POS printer requires external processing, ShtrihMkkt.epf. They are included in the distribution kit of the configuration releases and are posted on the website: https://releases.1c.ru/project/TradeWareEpf82. We need external processing.

We add processing to the directory "Processing of service of commercial equipment".

Now let's start adding the KKM itself to 1C. To do this, in "Connecting and configuring commercial equipment" go to the section "Cash register with data transfer" and create a new cash register.

We indicate the cash desk with which the trade equipment will interact and go to the "Parameters".

In the POS printer parameters, fill in the following fields:

- A computer- indicates the external IP of the computer to which the ATOL 55F KKM is connected and port 6220, which we opened for access via the Internet. For example, 10.10.10.10:6220

- Port- COM-port to which KKM ATOL 55F is connected on the local computer. In our case, this is COM3.

- Speed- COM port speed.

- Model- model of our KKM.

- Leave the rest of the fields as they are.

Now you can click on "Test device". A request will be sent to the POS printer on the local computer. If everything is configured correctly, then 1C will display the message “The test was successfully completed. ATOL 55F, no. **********, version: 3.0.1245 RU, FISK ". This means that you have configured everything correctly.

Errors may occur during testing. You may not have opened port 6220 on your local computer for Internet access. You may need to create firewall rules for inbound and outbound connections to port 6220. You may have forgotten to close the POS printer driver or start the FDSVC service. Or maybe you started 1C not on behalf of the administrator and 1C did not connect the KKM driver.

How to enable sending checks to the Fiscal Data Operator (OFD)?

If all is well and the test passes, you can now configure and enable the "EthernetOverUSB Service". This service sends punched checks to your Fiscal Data Operator (FDO).

To do this, you need to add a second COM port in the "Driver Management" on the local computer to which the KKM is connected, in the "EthernetOverUSB Service" tab, in our case it is COM4. Check the box next to "Autostart" and start the service.

That's it, now every broken check will be automatically sent to the OFD with which you have entered into an agreement.

OLEG FILIPPOV, ANT-Inform, Deputy Head of Development Department, [email protected]

Connecting online KKT to 1C

What difficulties do the amendments to FZ 54 bring us?

According to the amendments to 54-FZ, since February 2017, only CCPs of a new type are registered with the tax office, and since July 2017, CCPs of the old type are prohibited from use. New CCPs need new drivers and a new subsystem for working with retail equipment

According to the amendments to 54-FZ, since February 2017, only CCPs of a new type are registered with the tax office, and since July 2017, CCPs of the old type are prohibited from use. New CCPs need new drivers and a new subsystem for working with retail equipment

54-FZ, probably, became the law most frequently mentioned among IT professionals (and not only) in 2017, as was 152-FZ at the time. The timeline for this kind of change was too tight, so neither the business nor the service companies were ready for such a radical change. It is especially difficult, of course, for small businesses. But it also has some advantages - small businesses often use standard application solutions, which are not subject to individual modifications, so it is enough to simply update them. Worse, however, is the case for those who previously did not have any automation system. Now it will be almost impossible to work without it. This article will rather focus on large and medium-sized companies who will have to make a lot of efforts to adapt their information systems and software / equipment on the ground to meet the requirements of 54-FZ.

What is online CCP and how do they differ from ordinary ones?

Online KKM, which in the law are called KKT, at first glance do not differ significantly from those currently used. Their main function should be to submit checks to the tax office immediately after they are broken. In fact, this, of course, is not entirely in the tax and not quite right away. Checks are sent first to the FDO (Fiscal Data Operator), and the transfer can be postponed if there is no Internet connection. I still do not understand why it was necessary to make changes to the CCP, which prevented the transfer of checks using encryption and EDS at the software level, supplying the same fiscal sign received from the CCP. But, apparently, the logic here revolves not around convenience, but rather around money and the interests of service companies. All the same, the re-equipment of the KKT park is a budget in the region of 50,000 rubles. per piece.

But what, in fact, is the difference in online KKT? The main difference is, perhaps, in the fact that now in the CCP there is not an EKLZ unit, but a certain FN - a Fiscal accumulator. This contains information about checks and their transfer status. Apparently, there is no particular difference between him and EKLZ. You even need to change it with the same regularity. Although, it would seem, why store information about checks if they are transferred to the OFD. In addition, what prevented him from supplying it with a flash card of 64 gigabytes, then how many hundreds of years it will take to fill it with XML with check uploads. But the answer to this question was given above.

There is no need to buy a new CCP for online use, as a rule, the issue of replacing EKLZ with FN is solved in the course of a certain process called "modernization". The list of modernized CCPs can be found on the FTS website.

I cannot talk about all the CCPs, unfortunately, I saw them a little, but in relation to 1C, all online CCPs can be divided into three types, as shown in Fig. 1.

- KKT, serviced by drivers from the ATOL company. As a rule, this is a CCP manufactured by ATOL itself. But, one way or another, they are quite widespread, and in general the devices are not bad, but their cost is higher than that of the KKT from the Shtrikh-M company.

- KKT serviced by Shtrikh-M drivers. These KKM are, perhaps, the undisputed leader in the Russian market. Their price is low, which explains their prevalence. Moreover, this category includes not only CCPs produced directly by the Shtrikh-M company, but also many devices from third-party manufacturers. In my experience, Shtrikh-M drivers are more popular than ATOL. Although, of course, I have not seen official statistics.

- Offline KKT. They found a "second life" with the advent of the new law and have now become quite popular. The reasons are clear - this avoids a lot of difficulties when integrating with the automation system.

Other CCP models, of course, exist, but they most often represent a kind of hardware and software complex (something like a tablet integrated with a fiscal recorder, since the manufacturers have trained to make such devices even with the introduction of the Unified State Automated Information System). In this case, they do not need communication with 1C, as well as communication with any other system. Most often, such devices are popular with small and medium-sized businesses.

Online KKTs also differ from each other by the option of connecting to a PC. I have come across two options and sincerely hope that this list is exhaustive. So, the connection types can be as follows:

- USB is a very bad option. With it, emulation occurs on the computer network connection KKM by means of RNDIS technology. This technology is not the most widespread and widely used at the moment. Experienced IT professionals probably don't need to explain that if something is used extremely rarely, then this something contains a large number of not found software errors... In addition, on Windows XP, for example, this technology absent altogether. Although by some manipulation it can be "embedded" there using third-party software.

- Ethernet + COM / USB is a good and convenient option. The method of connection, in which the "old" version of the connection between the CCP and the PC remains, the "old" methods of printing receipts work. Only the fiscal part of the check is transferred by the KKT to the OFD via the Internet connection, which must be provided for it. In this case, the transmission of checks is not tied to the configuration of the PC, the presence of the Internet on it and the operation of RNDIS. All that is needed is to provide KKT with an Internet connection.

Read the entire article in the journal "System Administrator", No. 3 for 2017, on pages 60-62.

To connect the CCP with data transmission, you must perform preliminary steps - install the device driver and configure the device for Internet access. Internet access settings are made by means of the driver.

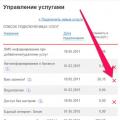

The device is connected to the program in the reference book. Connectable equipment (Administration – Connectable equipment).

The user needs to select the type of CCP equipment with data transfer and create new item reference book. Next, you need to select the organization on whose behalf the sale of goods will be made on this fiscal registrar and the device driver. In the field serial number, enter the serial number indicated on the body of the device. Then you need to press the button Tune and execute required settings drivers - port, network settings and other settings specific to this model. Press Device test.

If the device is connected successfully, a message will appear on the screen. The user can close the form using the button Burn and close.

2.Registering the fiscal accumulator

After connecting the KKT to the program, it is necessary to register the fiscal drive. This operation is also performed when the fiscal accumulator is replaced after the expiration of the validity period or the memory resource is exhausted: the used fiscal accumulator is closed, then the physical device is replaced and a new fiscal accumulator is registered.

To carry out the operation, you must select the item registration from the menu Fiscal accumulator operations... This will open a form where you need to fill in the field Registration number of KKT number obtained during the registration of the cash register with the Federal Tax Service, check the correctness of filling in the details of the Organization, indicate KKT installation address.

The user can select one or several taxation systems if it is planned to stamp checks on this machine to register settlements for goods and services related to activities with various forms of taxation. At the same time, in the event that sales are processed in the RMK, the program controls the composition of the check: one check may include goods whose balances are written off from warehouses with the same taxation system. Items are written off in accordance with the settings for the distribution of sales by warehouses and services by organizations. For more details see “Description of configuration Retail, revision 2.2”, section 2.2.2 Maintaining information about stores.

KKT settings include a number of signs of doing business. The user also needs to indicate the name and TIN of the fiscal data operator.

The registration data of the KKT is available for viewing in the card of the instance of the connected equipment.

Operation Changing registration parameters required when re-registering a fiscal accumulator. Depending on the selected reason for re-registration, the user has access to change the CRE details that he can change.

The registered device can be selected in the Cash register card of the KKM. For more details see “Description of configuration Retail, edition 2.2”, section 2.2.5 Maintaining information about the company's cash registers.

Important! We draw the attention of users that the distribution of proceeds by sections of the FR for the type of KKT equipment with data transmission is not supported. In the settings of Kass KKM for the type of KKT equipment with data transmission in the field Distribution of proceeds by sections of FR a pre-installed element of the settings reference is substituted, which cannot be changed. The work with fiscal registrars is maintained in the same volume.

3.Opening and Closing cash register shift

When opening a cash register shift with the command Open shift in the main menu of the RMK or on the form of the list of POS printer receipts, a document Cash change is created ( Sales - Retail Sales), in which we write Basic data current cash register shift: Organization, Cashier KKM to which the device is connected, Date and time of the start of the shift, status - Open... When the shift is closed, the time of the end of the shift is filled, the status changes to Closed and the page details are filled Fiscal data.

The composition of the details depends on the version of the Fiscal document formats supported by the fiscal accumulator and the cash register. The main details are displayed on the form, all available fiscal data can be viewed by clicking on the link to the data file.

4.Providing an electronic check to the buyer

In accordance with the new version of the law on the use of cash registers (54-FZ), the seller must provide an electronic check at the buyer's request. The user of the program can fulfill this requirement using the functions of the program. To do this, you need to configure the mail agent and service provider for sending SMS messages. For more details see “Description of configuration Retail, revision 2.2”, section 9.5.2 Settings of the “Organizer” section.

If the e-check transmission settings are set, customer e-checks will be placed in the message queue for sending. The administrator can set the settings for sending messages from the queue ( Sales - 54-FZ) - immediately after the receipt is broken or set up automatic delivery according to the schedule.

When registering a sale in RMK, the cashier now has the opportunity to enter the buyer's phone number or e-mail before paying for the purchase. Several methods are supported to determine the customer's contact information:

- data can be entered manually;

- to read the barcodes of the business card of the application developed by the order of the Federal Tax Service for the buyer by the scanner;

- Phone and e-mail can be determined using the buyer's discount card, if these data are stored in the infobase.The search for a buyer's discount card in the RMK interface, when viewing the list is prohibited, is carried out not only by the code, but also by the phone number, e-mail and surname of the buyer. In this case, after choosing a card, an SMS confirmation code for this operation is sent to the owner's number. The ability to select a card when searching without SMS confirmation is regulated by an additional user right Allow map selection by e-mail without confirmation when searching or Allow card selection by phone number without SMS confirmation when searching. At established law the system will not require confirmation by the code sent by the program to the buyer.

In the form of payment of the RMK, buttons for entering a subscriber number or address are displayed Email buyer. If the number was recorded in the information base earlier and is determined using a discount card, the cashier is given the opportunity to delete data from information base at the request of the buyer using the reversible key on the data entry / display form. After breaking the check digital copy the check will be queued for data transmission.

The administrator has the ability to control the status of the queue of electronic checks ( Administration– Sales– Law No. 54-FZ). The transition to the queue is carried out by the link Open the queue of electronic checks.

The administrator can open unsent messages and read the error message. After eliminating the error, you can select unsent messages and send again using the command send command bar list or delete if sending is not possible. The queue state of the open form is updated using the button Refresh... Link Configure sending electronic receipts you can go to the form for setting up a routine task for sending checks.

This message has no labels

Print (Ctrl + P)

KKT with data transmission (54-FZ)

This is a device for registering trade operations and generating checks with the subsequent sending of data on the registered operation to the OFD... In the cash register with data transmission, fiscal accumulators are used - blocks responsible for entering, storing and transmitting data about all payments made during the year. At the time of making a purchase, the cashier issues electronic (via e-mail or SMS) and paper receipts. The peculiarity of the CCP with data transfer is that all information about payments is transferred through the fiscal data operator (OFD) to the tax office.

In the form of connecting and configuring commercial equipment of the new edition of 1C: Trade Management 10.3.40, released in January 2016, the ability to unload processing of the service of the form "KKT with data transmission" supporting work with cash registers with the function of transferring data to the operator of fiscal data in accordance with Federal Law of 22.05.2003 N 54-FZ "On the use of cash registers when making cash settlements and (or) settlements using electronic means of payment "

Firm "1C" supports work with the most common models of KKT companies "ATOL" and "Shtrikh-M". Added handling of hardware maintenance supported by drivers:

- Driver "Shtrikh-M: KKT with data transfer to OFD (54-FZ)" version 4.13, developed by "Shtrikh-M"

- Driver "ATOL: KKT with data transfer to OFD (54-FZ)" version 8.12, developed by the company

A constantly updated list of certified hardware models supported by these drivers,. In particular, the requirements for the drivers of the connected equipment submitted for certification to the company "C" to obtain the logo "Compatible! System of programs 1C: Enterprise ", version 8.3 are made in the following KKT with data transfer:

- ATOL-25F, ATOL-22F (ATOL FPrint-22PTK), ATOL-55F, ATOL-11F, ATOL-30F, developed by ATOL,

- "RETAIL-01F", developed by "Shtrikh-M"

Document "Cashier shift"

The document “Cashier shift” has also been added to the “Shop equipment” subsystem, version 10.3.40. The document contains the data of the cash register shift received from the cash register at the time of opening and closing the shift.

Cashier shift - the period of the cashier's work at the cash register. This period of work is recorded in the document Cashier shift.

List of documents. For the convenience of work, the User can filter the list of shifts by workplace and fiscal device by selecting desired values in the corresponding fields of the list header. Using the Ctrl + F command, you can filter the list by any combination of characters. Using the service Advanced search (Alt + F), which is launched from the command panel of the list, the User can select the required shifts by setting the search by the values of various requisites.

new document created automatically when opening a shift . After executing the command, the system informs the user about the opening of the shift.

On deposit "Basic data" form of the document, there is information about the organization, the fiscal device on which the shift is open, the date and time of opening the shift, the status of the shift (open or closed).

In the case of using a cash register with a data transfer that supports the transfer of fiscal documents in XML format, on the deposit Fiscal data information is available about the number and date of the CCP change, the number of strict reporting forms and fiscal documents per shift, as well as the date and time of the first document not transmitted to the operator of fiscal data and the total number of such documents. If there are warnings about the state of the fiscal drive, such as: memory overflow, resource exhaustion or the need to replace, information about this will be displayed in the document header.

54-FZ: basic provisions

Amendments to the law concern almost everyone who carries out cash payments and / or settlements using electronic means of payment (payment cards, electronic money etc.).

From July 1, 2017, organizations and most individual entrepreneurs must use only the new generation CCP (online CCP).

The peculiarity of the new online cash registers is that information about settlements from each online cash register is transmitted to the Federal Tax Service of Russia through the fiscal data operator (OFD).

Online CCPs must be connected to the internet; autonomous use CCP is provided only for regions with poor communication.

The composition of the mandatory information in the check is expanding - it must include the names of goods (services) and VAT.

Fines are increased to 30,000 rubles, the statute of limitations is increased to one year.

There is a involvement of buyers in civil control.

Who should and who should not use CCP: list of exceptions.

54-FZ: SWITCHING TO NEW CASH REGISTERS, CONNECTING TO OFD. ASSISTANCE TO ORGANIZATIONS AND ENTREPRENEURS

54-FZ: support in 1C solutions

Firm "1C" cooperates with manufacturers of cash register equipment and operators of fiscal data. In the programs "1C: Enterprise 8" functions are implemented for effective and comfortable work with online checkouts.

In standard 1C solutions, the requirements of 54-FZ are timely supported:

- 1C: Retail (version 2.2)

Work according to the rules of 54-FZ: all the possibilities in 10 minutes (video) - 1C: Management of our company (version 1.6)

- 1C: Accounting 8 (revision 3.0)

Work according to the rules of 54-FZ: all the possibilities in 15 minutes (video) - 1c accounting state institution(revision 2.0)

- 1C: Trade Management (revision 10.3)

- 1C: Manufacturing Enterprise Management (revision 1.3)

- 1C: Integrated Automation (version 1.1)

- 1C: Trade and warehouse 7.7

- Manufacturing + Services + Accounting 7.7

- Complex configuration 7.7.

Especially for small retail, a new hardware and software complex "1C: Cashier" was released, which consists of an autonomous cash register and a cloud application (online service) "1C: Cashier" deployed in the service "1C: Enterprise 8 via the Internet"

IMPORTANT: The 1C solutions already support the fiscal data format (FFD) 1.05. You can view a list of programs with the implementation of these changes.

Mobile applications

- 1C: UNF

Work according to the rules of 54-FZ: all the possibilities in 3 minutes (video) - IP6% - an application for individual entrepreneurs without hired workers applying the simplified taxation system (STS) with the object of taxation "Income"

Available for iOS, Android, Windows Phone

List of drivers and cash registers certified to work with 1C programs

- Models of certified cash registers with data transmission

- Hardware Models Supported by Certified Drivers

Please note that the following 1C cloud applications work with the Shtrikh-Mpei-F cash register:

The Connected Hardware Library is used to support changes in the listed solutions. This approach ensures the methodological unity of decisions and the timely implementation of changes.

How to deactivate the "You've received a call" service from MTS?

How to deactivate the "You've received a call" service from MTS? Factory reset and hard reset Apple iPhone

Factory reset and hard reset Apple iPhone Factory reset and hard reset Apple iPhone

Factory reset and hard reset Apple iPhone